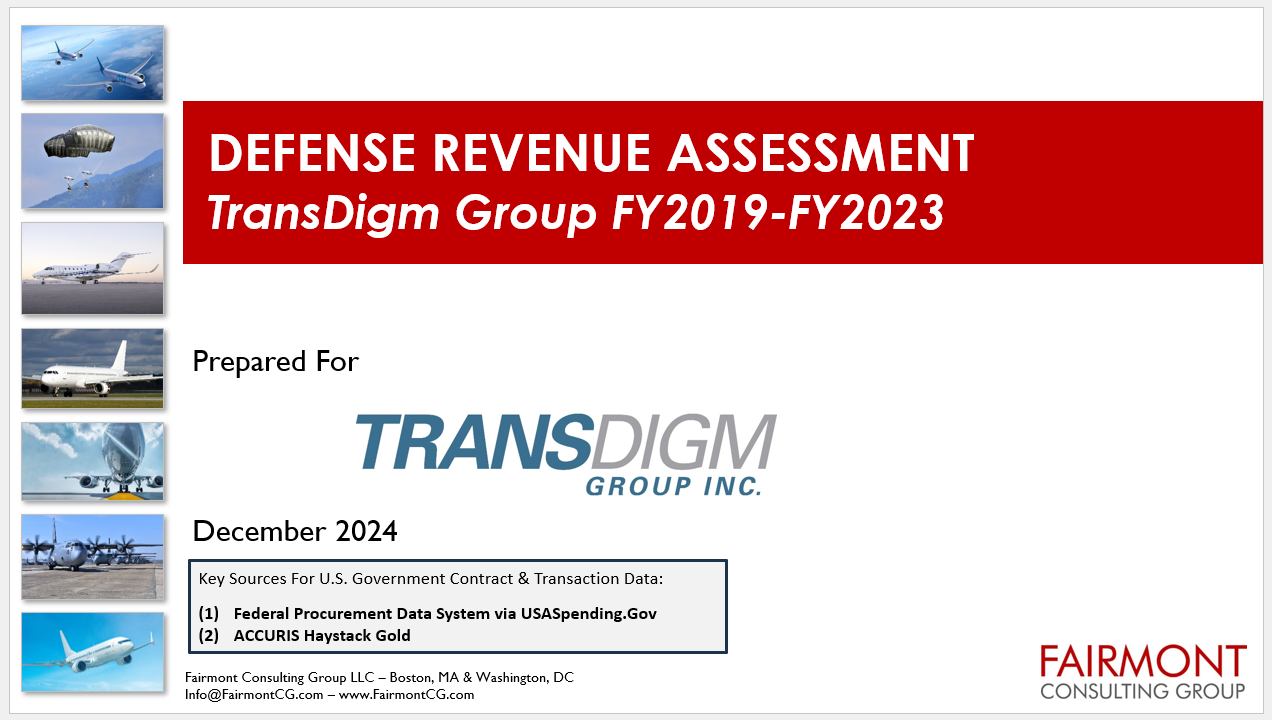

58%

Average Global Commercial Sales *

35.5%

Average Global Defense Sales *

6.5%

Average Direct to DoD Sales *

* Average of FY19-FY23 Revenue

TransDigm engaged a third-party firm, Fairmont Consulting Group, to compile and analyze direct U.S. Department of Defense (DoD) sales data as reported publicly by the U.S. Government through the Federal Procurement Data System via USASpending.gov and ACCURIS Haystack Gold. Fairmont provided the following analysis:

Fairmont analyzed contract sales data from FY2019 to FY2023 and found that direct sales to the DoD account for approximately 6.5% of TransDigm’s revenue.

Global Commercial Sales includes sales supporting commercial civilian air travel. Global Defense Sales consists of sales to support global military end use, including sales by global locations to allied nations.

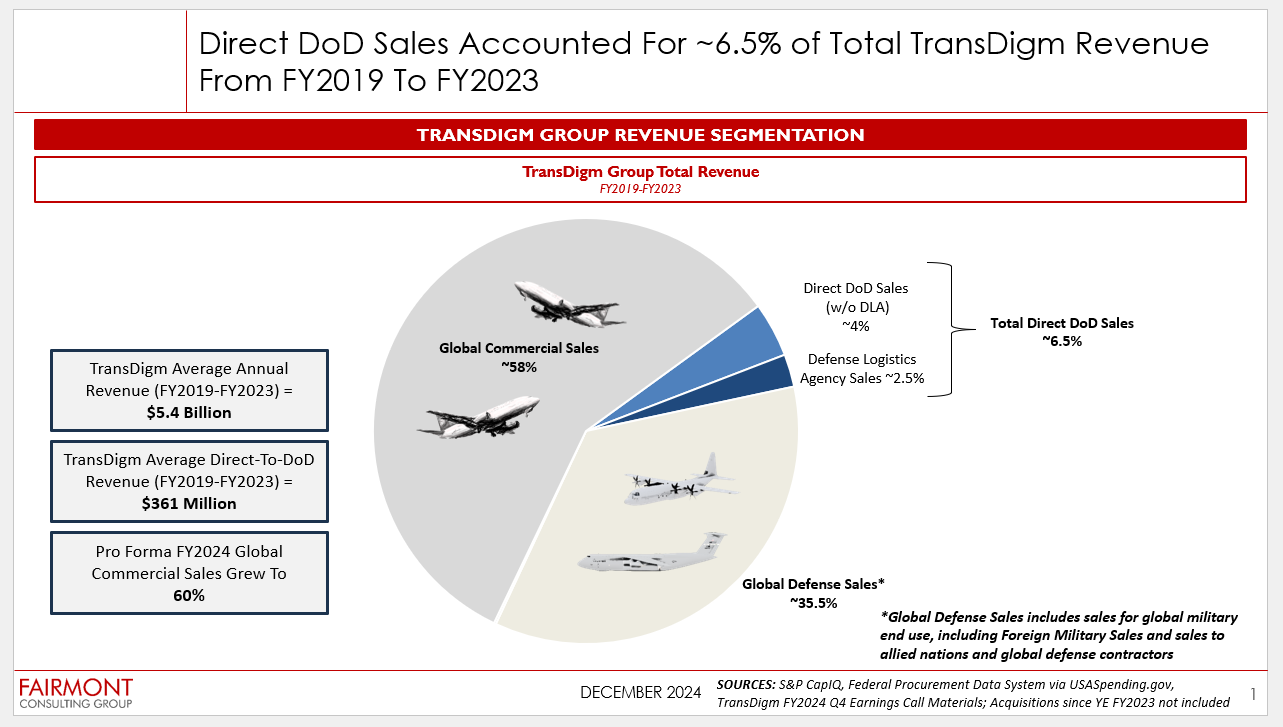

1.3%

Average Annual Revenue from DoD Sales Not Subject to TINA, Competition, or Commercial Market Data*

* Average of FY19-FY23 Revenue

The analysis found that the majority of TransDigm's direct DoD sales revenue is negotiated based on certified cost analysis (a/k/a TINA), competition amongst multiple bidders (non-TransDigm companies), or determination of commerciality by the DoD.

Only a de minimis amount of TransDigm’s average annual revenue (approximately $70M) comes from contracts below the TINA threshold that are not negotiated through competition or commercial market analysis. This represents 1.3% of TransDigm’s average annual sales.

This group of contracts is typically low-quantity, low-value POs for spot buys, usually through the Defense Logistics Agency (DLA), and represent the types of contracts that have been the subject of prior DoD audits. Although these contracts are a very small part of TransDigm’s sales and often fall below the DoD’s micro-purchase threshold, TransDigm businesses are trained to provide cost or pricing data such as examples of invoices to other customers or cost data as required.

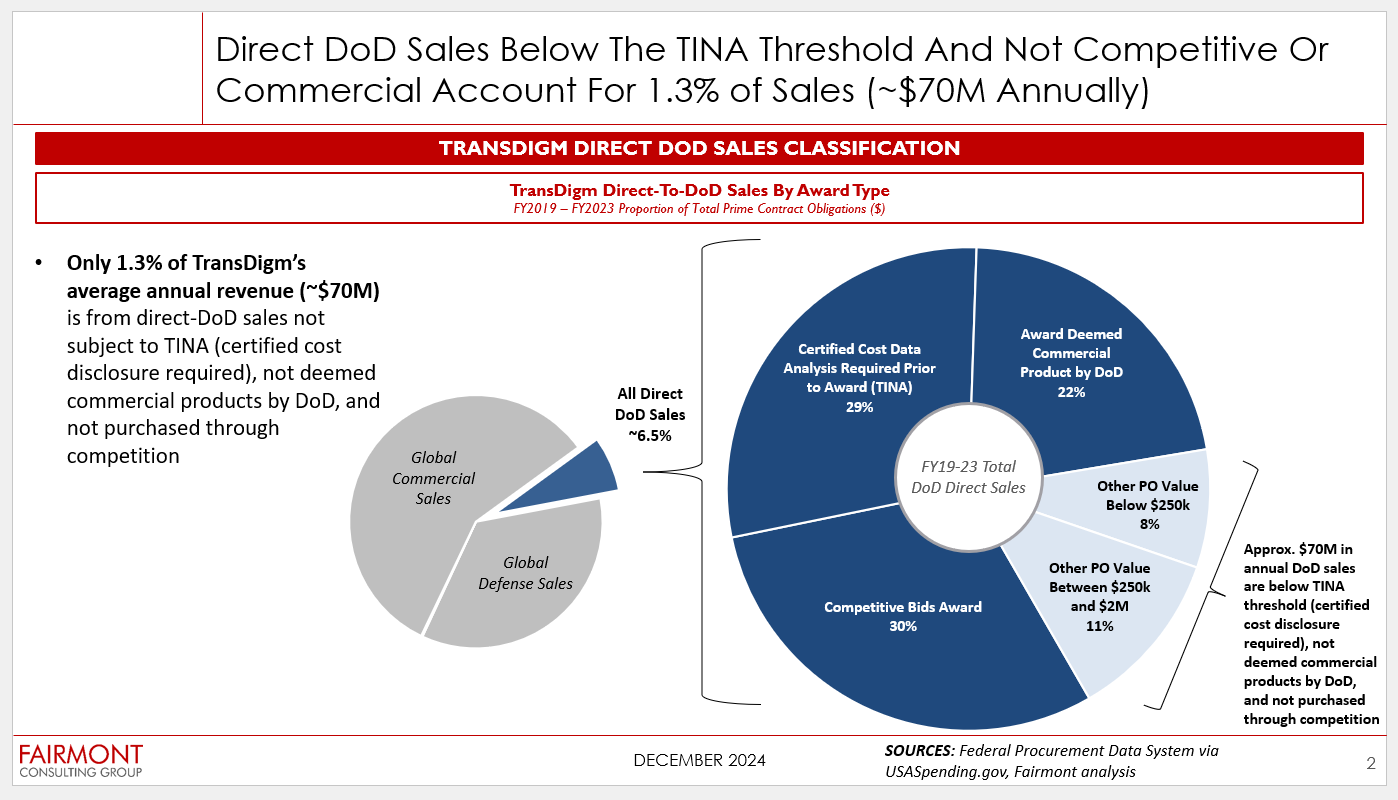

Prior DoD Audits have focused on TransDigm sales to the DLA which are typically through low-quantity, low-value purchase orders. Procurements from TransDigm represent a miniscule amount of annual spend by the DLA.

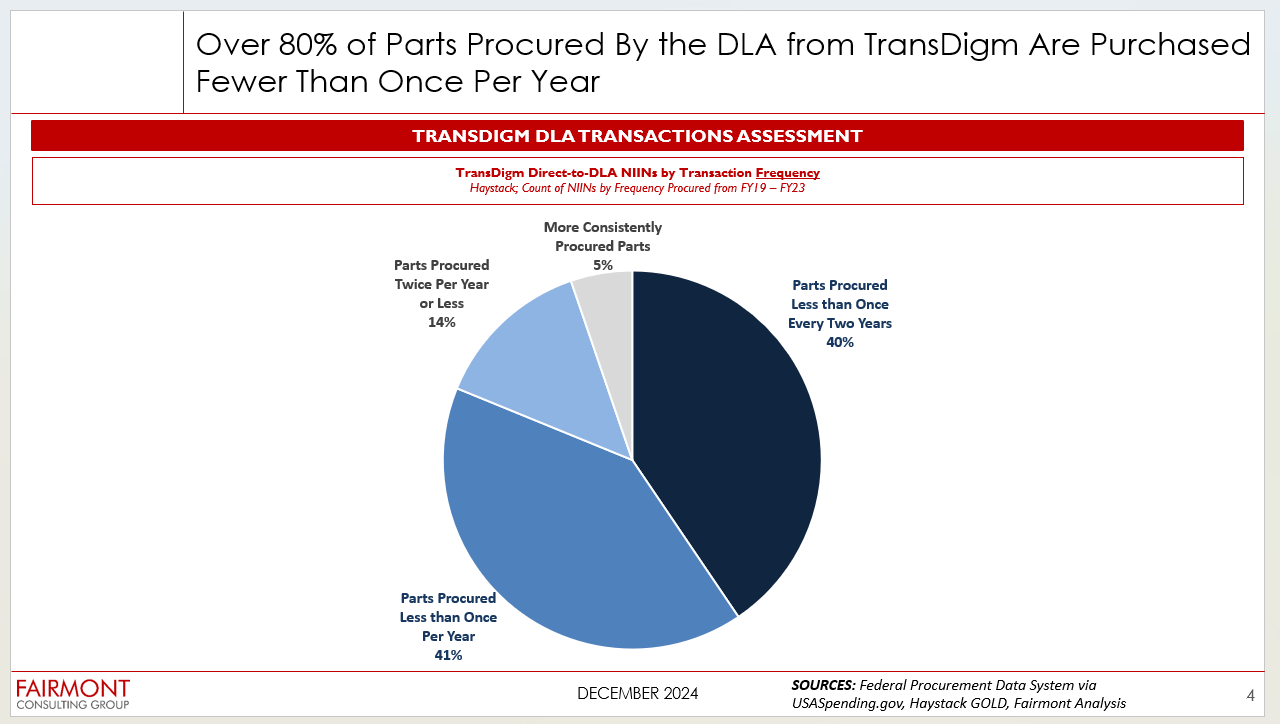

DLA procurements are typically spot buys with over 80% of the parts procured fewer than once per year.

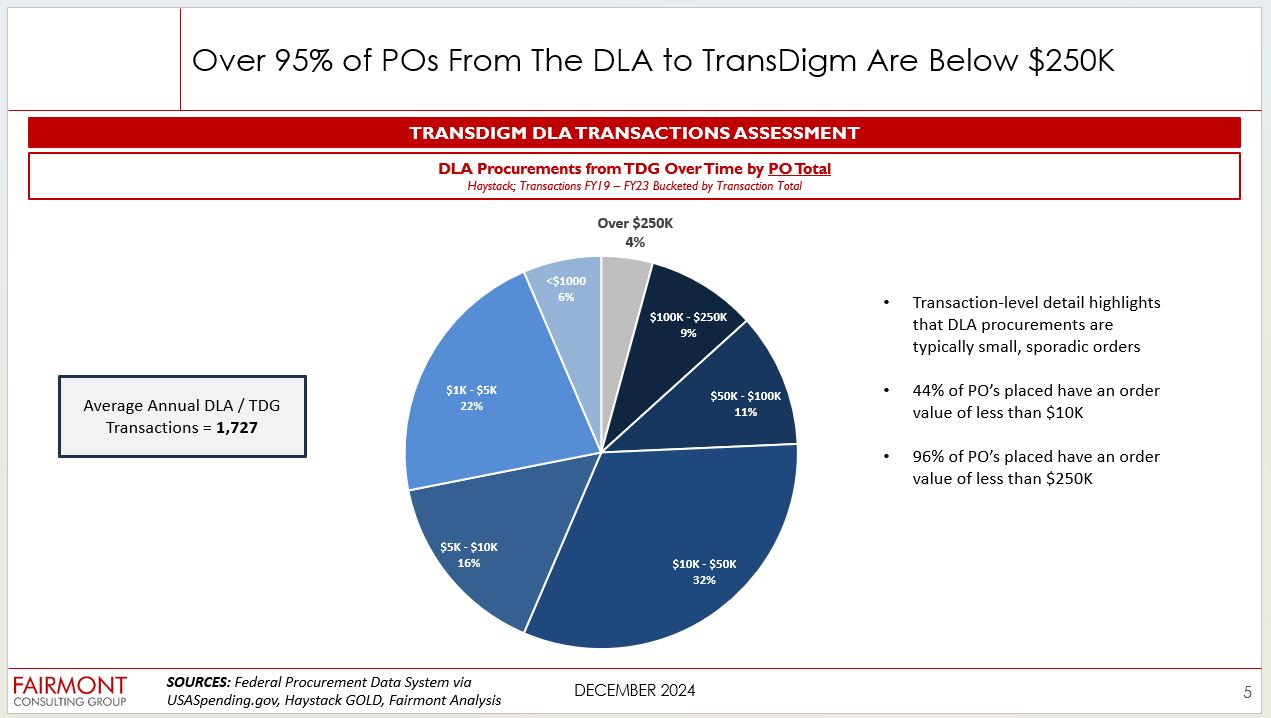

Nearly all POs issued by the DLA to TransDigm companies are below $250k based on low quantity.